Banks could become identity brokers by analyzing and using the information they know about their clients, and giving that insight over to customers or other vendors for specific products and services, like insurance, and creditworthiness.

Banks could become identity brokers by analyzing and using the information they know about their clients, and giving that insight over to customers or other vendors for specific products and services, like insurance, and creditworthiness.

There is a significant behavioral gap between the consumer and the institution— one that is now being filled rapidly by better-positioned non-bank competitors like PayPal, Square, Apple, Starbucks, P2P lenders and many more. Banks need to consider and support an identity driven architecture and business model to open its services and to support Apps market place that banks could offer to customers that will protect their digital identities against fraudulent activity, stay compliant and can push innovations to the edge.

The growth in person-to-person (P2P) lending seems to be successfully coordinating lenders and borrowers via the Internet rather than through institutions. The great success of global P2P business models, has fueled successful OZ start-ups like Society One.

A recent Australian Financial review article states “Moguls take on power of big banks”: James Parker and Ryan Stokes have described peer to peer lending as a global force triggering a transformation of banking as they back Sydney start-up SocietyOne to eat into the profits and margins of major Banks. “Unlike many sectors, banking is an area that has been largely undisputed”.

If the regulation of payments and the regulation of banking diverge, with a lighter touch for payments in contrast to the well-understood demands for tighter regulation in the banking sector, it seems very likely that the business of banking and the business of payments will separate too. We will get a vigorous and innovative payment sector. Banks will be more tightly regulated because they create money by lending. Anyway with P2P lending they will get squeezed too.

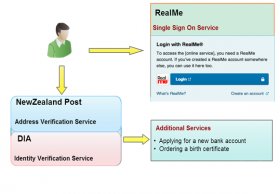

P2P lending seems to be successfully coordinating lenders and borrowers via the Internet rather than through institutions. Identity and Credit verification has been a very important process supported by GreenID and Veda. It also enables companies in meeting statutory obligations, including the Anti-Money Laundering and Counter-Terrorism Financing Act.

Today, nearly 20% of Kenya’s gross domestic product moves through M-PESA, the nation’s mobile-money system operated by Safaricom, its leading mobile network. Kenya’s bank regulators did not intervene to stop a mobile operator from offering financial services. In the case of M-PESA, for example, users must be in the presence of one of the system’s agents to send or receive money. It’s the agent who verifies the user’s identity, makes a record of the transaction, and holds the cash involved. Most M-PESA outlets (an agent may have more than one) handle 50 to 100 transactions a day. In many nations, however, methods to create profits at scale have not been worked out. Instead, providers have rushed to sign up agents without paying enough attention to the skills needed for success or to the business case for local stores and traders to participate.

Another disruptive space is NFC AND mobile payments, a key goal for banks moving into the mobile-money space would be simply to get more customers to use mobile, which in turn will spur more businesses to accept it. Retailers, meanwhile, see everything a customer does with them, “but banks, through the credit card, through the transaction history, see everything the customer does with everybody, ”. This offers banks an opportunity to develop “a more comprehensive profile of who their customers are and what they’re doing” in order to provide tailored products and services.

Banks and other financial services firms are currently required to verify an individual by using government-issued, paper-based credentials such as a passport or drivers license.

It is imperative for Banks to consider Identity as part of their digital strategy to retain and expand customer base, to build brand loyalty, in building a successful Apps market place and in providing the right incentives to the right people. A new thinking about Identity is required to support this App, API and Authentication paradigm.

INTERESTING VIDEO